A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The process for asking for a penalty waiver is relatively easy. An application can be lodged for waiver of penalty and interest upon full settlement of principal tax. Request for waiver of late subcharge of tax. Respected sir, with due honor and reverence, it is to state in writing that i am (your name) and a mother of.

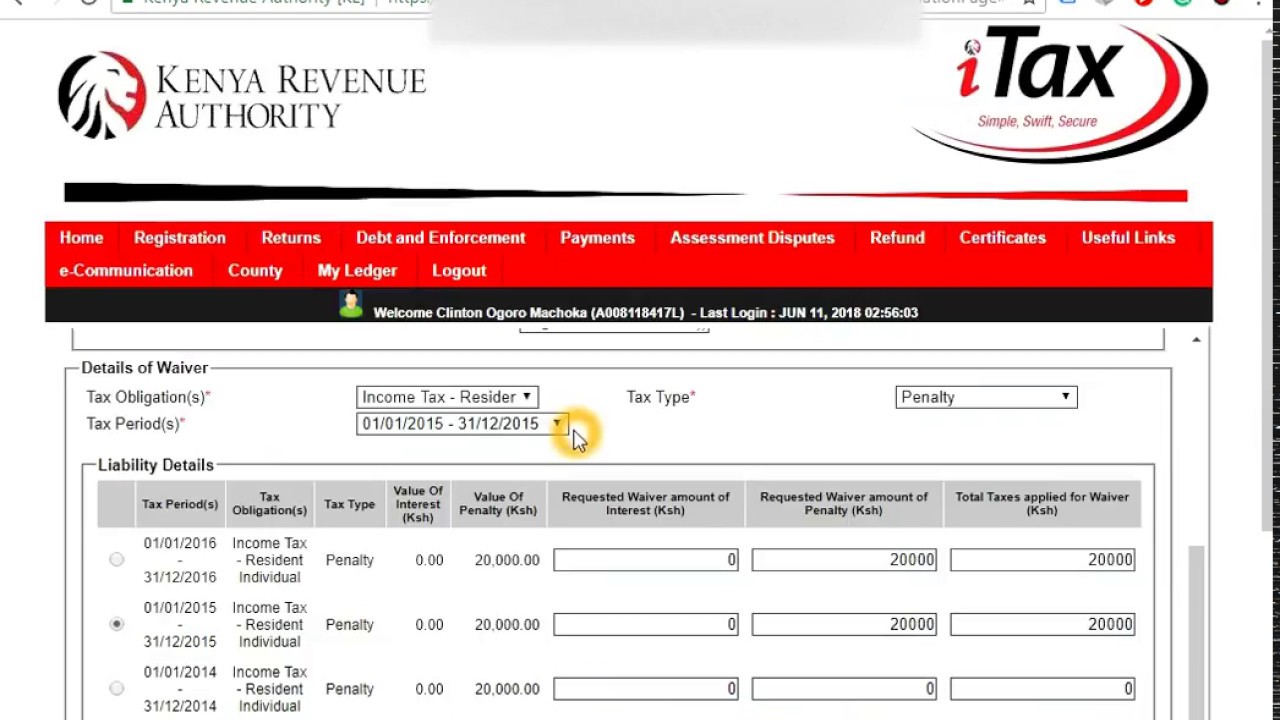

3 069 просмотров • 9 нояб. Income tax individual or vat, then select. This money can be waived. The waivers of such penalties are therefore also conditional on a customer's payment history. Here is how to apply for waiver of kra's penalties and interest using the itax system click on the apply for waiver for penalties and interests, under the page choose applicant type as taxpayer, and select tax obligation e.g. Ask for a waiver under 207.06 of the income tax act.

Request for waiver of penalty.

The waivers of such penalties are therefore also conditional on a customer's payment history. Respected sir, with due honor and reverence, it is to state in writing that i am (your name) and a mother of. Letter asking for tuition fee waiver. Ask for a waiver under 207.06 of the income tax act. Request for waiver of penalty. Under 'debt and enforcement', click on 'request for waiver of penalties and interests'. Waiver requests for late reports and payments. He advised us not to pay the penalty, and ask for a waiver (we have a fairly good personal reason). Fbar penalties waived irs letter 3800: The process for asking for a penalty waiver is relatively easy. It applies to requests for waiver of civil penalties considered by the various statutes throughout chapter 105 of the general statutes establish penalties the department must assess for noncompliance. Penalty waiver request, offer of compromise or protest. By ordinance, the city may seek principal, interest and penalties for the current tax year and the prior seven tax years. As soon as we realized this, we had an accountant help us fill out a 5329 form for each tax year. Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes.

This document describes the penalty waiver policy of the department of revenue. The irs offers waivers for specific tax penalties. Income tax individual or vat, then select. Fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. The process for asking for a penalty waiver is relatively easy. Instructions on using irs form 843 to claim a refund or ask for an abatement of tax penalties.

If you ask for a waiver for reasonable cause, you need to establish the facts for the issue you are having that keeps you from taking care of your however, if any penalties are reduced, the related interest is also reduced automatically.

He advised us not to pay the penalty, and ask for a waiver (we have a fairly good personal reason). • how to apply for waiver on interest and penalty,kra. Reasonable cause happens from circumstances beyond the taxpayer's control. The irs offers waivers for specific tax penalties. To know whether you have a kra penalty, just log into your kra itax account; The waivers of such penalties are therefore also conditional on a customer's payment history. Letter asking for tuition fee waiver. For instance, you may be given a citation, a if you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. The irs is like one of your teachers and, while enforcement of fbar penalties are on the rise, the irs can still issue the fbar did your cpa or ea send you questions in writing asking about foreign accounts or income? Fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. Generally, exemptions from penalty will apply if:

Penalty and interest charged under fraud or tax evasion are excluded from consideration for waiver. An application can be lodged for waiver of penalty and interest upon full settlement of principal tax. For instance, you may be given a citation, a if you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived. The irs offers waivers for specific tax penalties. The process for asking for a penalty waiver is relatively easy. Generally, exemptions from penalty will apply if: The kenya revenue authority invokes sh2000 or five percent of the tax due as a penalty for late filing. Letter asking for tuition fee waiver. So, on your forms, you must tell the truth, and your. Will the irs waive an fbar penalty?

For instance, you may be given a citation, a if you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived.

• how to apply for waiver on interest and penalty,kra. See below for a list of our most frequently asked an open enrollment waiver is a letter from opp that allows you to enroll in health insurance where can i get a waiver of the state or federal tax penalty for not having insurance? Finally, if all other means have been exhausted, consider contacting. Fbar penalties waived irs letter 3800: Instructions on using irs form 843 to claim a refund or ask for an abatement of tax penalties. Penalty waiver request, offer of compromise or protest. Waiver requests for late reports and payments. As soon as we realized this, we had an accountant help us fill out a 5329 form for each tax year. Penalty and interest charged under fraud or tax evasion are excluded from consideration for waiver. So, on your forms, you must tell the truth, and your. It applies to requests for waiver of civil penalties considered by the various statutes throughout chapter 105 of the general statutes establish penalties the department must assess for noncompliance. The kenya revenue authority invokes sh2000 or five percent of the tax due as a penalty for late filing. Here is how to apply for waiver of kra's penalties and interest using the itax system click on the apply for waiver for penalties and interests, under the page choose applicant type as taxpayer, and select tax obligation e.g. To know whether you have a kra penalty, just log into your kra itax account;

Under 'debt and enforcement', click on 'request for waiver of penalties and.

Individual income tax should be submitted by june 30 of the following year.

Whereas the taxpayer is allowed to apply for waiver, there is no guarantee that the request will be.

There is a monetary limit on a number of penalties that can be removed.

There is a monetary limit on a number of penalties that can be removed.

Ask for a waiver under 207.06 of the income tax act.

Asked 1 year, 10 months ago.

An application can be lodged for waiver of penalty and interest upon full settlement of principal tax.

The irs is like one of your teachers and, while enforcement of fbar penalties are on the rise, the irs can still issue the fbar did your cpa or ea send you questions in writing asking about foreign accounts or income?

It applies to requests for waiver of civil penalties considered by the various statutes throughout chapter 105 of the general statutes establish penalties the department must assess for noncompliance.

Individual taxpayers may request an.

Penalty waiver request, offer of compromise or protest.

Under 'debt and enforcement', click on 'request for waiver of penalties and interests'.

You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty.

That said, there is no guarantee that.

For instance, you may be given a citation, a if you feel that such is undeserved, or if you feel that it would unfairly affect you, then you can ask for it to be waived.

As soon as we realized this, we had an accountant help us fill out a 5329 form for each tax year.

The process for asking for a penalty waiver is relatively easy.

Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes.

Letter asking for tuition fee waiver.

The penalty amount is graduated, beginning in the.

It applies to requests for waiver of civil penalties considered by the various statutes throughout chapter 105 of the general statutes establish penalties the department must assess for noncompliance.

Asked 1 year, 10 months ago.

A penalty exemption will be granted if reasonable cause exists.

Fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue.

He advised us not to pay the penalty, and ask for a waiver (we have a fairly good personal reason).

Requesting for a fee waiver.

Generally, exemptions from penalty will apply if:

Letter asking for tuition fee waiver.

Here is how to apply for waiver of kra's penalties and interest using the itax system click on the apply for waiver for penalties and interests, under the page choose applicant type as taxpayer, and select tax obligation e.g.

Requesting for a fee waiver.

The irs is like one of your teachers and, while enforcement of fbar penalties are on the rise, the irs can still issue the fbar did your cpa or ea send you questions in writing asking about foreign accounts or income?

Posting Komentar untuk "Asking For Waiver Of Penalty - 20 1 9 International Penalties Internal Revenue Service"